Activate the added tax

HESABATE contains a system for processing and calculating the TAX in all program bonds and bills that are affected by the value of the added tax.

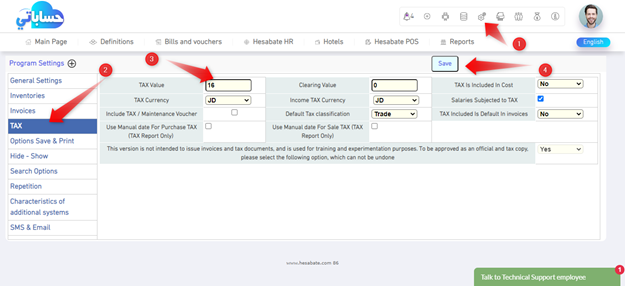

First: the activation of the TAX (fixed value)

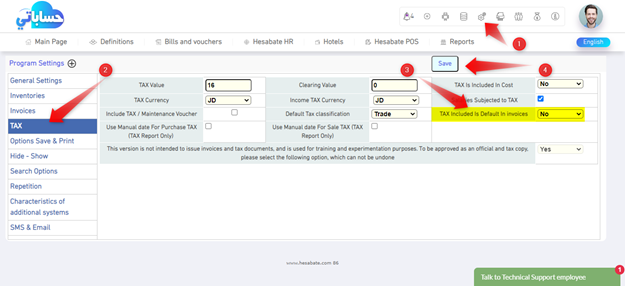

To activate the value of the value-VAT and set a fixed value for it that is added to all bonds and invoices subject to TAX in the program, open the program properties and then enter the TAX value as it is in your country in the field of value-added tax, and specify the currency of the TAX as shown in the picture

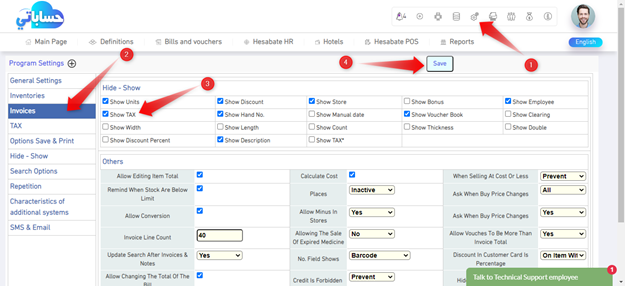

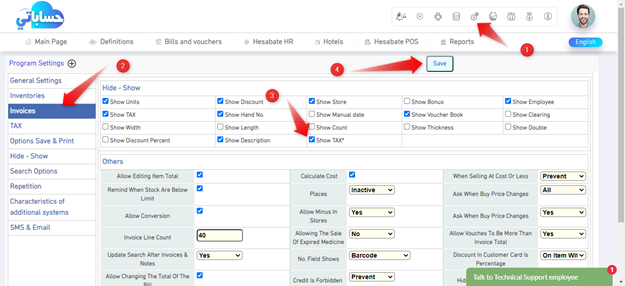

Open the billing properties, and then activate the tax option as shown in the following image

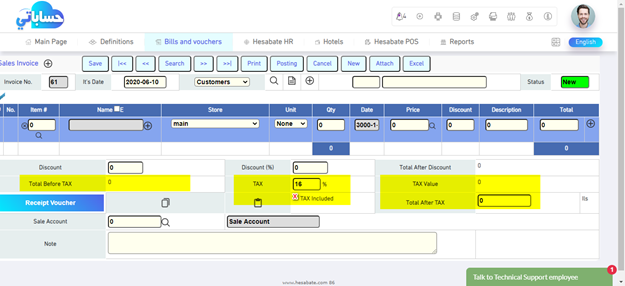

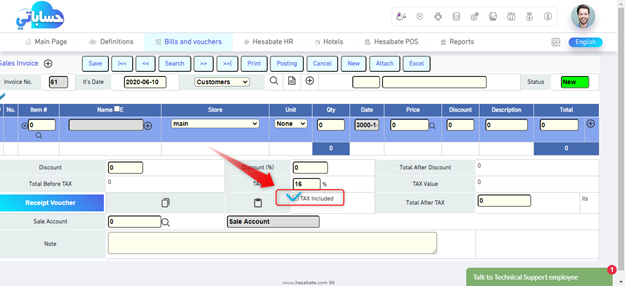

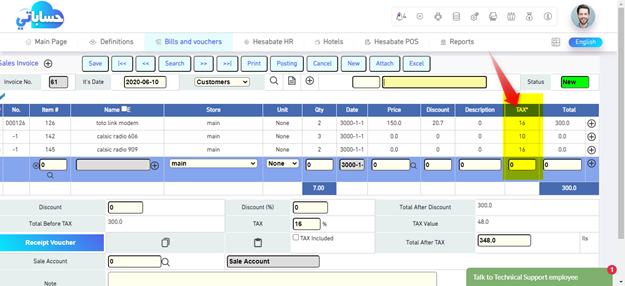

Once the tax is activated, all fields related to the tax will appear at the bottom of all invoices and bonds, as in the example.

The price of the merchandise that is entered in the invoices includes the added tax, and in case you want to add the tax to it, remove the option that includes the tax from the bottom of the invoice.

In the event that you want the prices not to include the TAX by default, enable this option from the program properties then TAX

Second: activating the TAX (variable value for each item)

In the event that each product has a different tax according to your state law, open the program properties and then activate the tax column in the bills from the billing properties

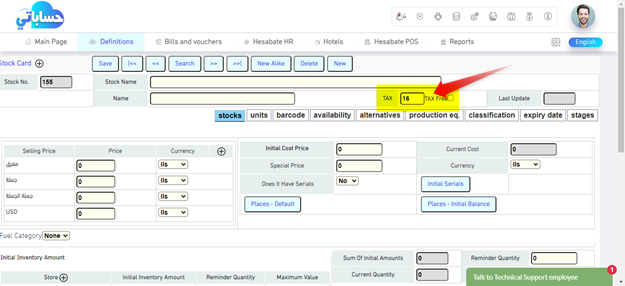

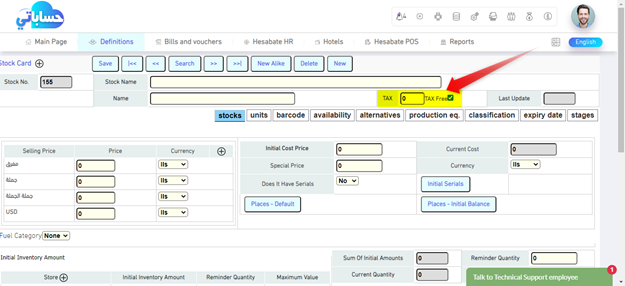

Determine the tax value for each item on the stock card.

You will see the tax value for each item in your invoices as in the example below, and you can adjust it.

In the event that there is an exempt tax for any item, you can select the exempt option on the stock card for any item.

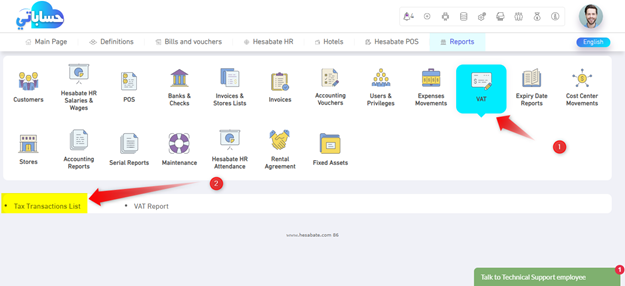

Three, VAT reports

The program contains a report in the name of (VAT Transactions List), where all bonds and bills affected by the value of the VAT can be shown through this bond, in addition to many other options that are available within this report.

You can find this report in the reports screen under the heading VAT.